- All

- Product Name

- Product Keyword

- Product Model

- Product Summary

- Product Description

- Multi Field Search

Views: 0 Author: Site Editor Publish Time: 2025-07-16 Origin: Site

Smart technology now drives rapid change in the small paper bag making machine sector. Automation, AI, IoT, and digitalization have become essential for manufacturers who want to lead the bag making machine market. Recent data shows the bag making machine market will reach $500 million by 2025, with Asia-Pacific generating more than 35% of total revenue growth. The industry focuses on sustainability and environmental impact, with eco-friendly materials and smart manufacturing processes supporting sustainable packaging. New technologies help reduce waste, protect the environment, and boost efficiency for companies producing paper bags and packaging.

Statistic/Trend Details Market Size (2025) $500 million Growth Drivers Automation, AI, IoT, data analytics, sustainability Regional Growth Asia-Pacific: 35%+ of revenue growth Environmental Impact Bio-based materials, reduced waste, smart manufacturing

Smart technology like automation, AI, IoT, and digitalization is transforming small paper bag making machines by boosting efficiency and quality.

Automation streamlines material handling and assembly, reducing waste and labor costs while increasing production speed.

AI enables predictive maintenance and real-time quality control, helping prevent breakdowns and ensuring consistent bag quality.

IoT connectivity allows real-time monitoring and remote support, improving machine reliability and reducing downtime.

Digitalization and data analytics help manufacturers optimize production, reduce costs, and respond quickly to market demands.

Sustainability drives the market with eco-friendly materials, energy-saving processes, and designs that support recycling and composting.

Customization options grow as smart machines produce various bag sizes, styles, and personalized designs to meet diverse customer needs.

Challenges like high investment costs, skills gaps, integration issues, and data security require careful planning and workforce training.

Automation stands at the forefront of technological advancements in the bag making machine industry. Manufacturers now rely on automation to streamline production, reduce errors, and increase output. The integration of automation and advanced technologies has transformed both large-scale and small paper bag making machine operations.

Modern bag making machines use automated systems to manage raw materials efficiently. These systems transport paper rolls, align them, and feed them into the machine with precision. Automatic tension control and material alignment ensure consistent quality and minimize waste.

Fully automatic bag making machines deliver high-speed performance with minimal human intervention.

Semi-automatic bag making machines offer flexibility for smaller businesses, balancing manual and automated processes.

Automated material handling reduces labor costs and supports sustainability by optimizing material use.

Automated assembly processes have revolutionized bag manufacturing. Machines now handle folding, gluing, sealing, and cutting with remarkable accuracy.

Features such as automatic sealing mechanisms and flap creation systems contribute to faster production cycles.

Consistent assembly quality leads to fewer defects and higher customer satisfaction.

A case study from GreenLeaf Packaging Solutions demonstrates that adopting high-speed automated machines results in significant improvements in production efficiency and output. Automation not only boosts speed but also ensures that each bag meets strict quality standards.

AI integration represents a major leap in technological advancements for the bag making machine sector. Artificial intelligence enables machines to learn from operational data, adapt to changing conditions, and optimize performance over time.

Predictive maintenance powered by AI sensors detects potential failures before they cause downtime.

Machine learning algorithms analyze data from sensors to forecast component wear and schedule maintenance proactively.

This approach extends machine lifespan and reduces unexpected breakdowns.

| Aspect | Benefits of AI Integration in Small Paper Bag Making Machines |

|---|---|

| Predictive Maintenance | AI sensors detect potential failures, reducing downtime and extending machine lifespan. |

| Real-time Process Optimization | AI adjusts machine settings dynamically to improve efficiency and output quality. |

| Intelligent Quality Control | AI-driven image recognition ensures consistent product quality and reduces defects. |

| Production Speed | Automation and AI increase production speed, lowering manufacturing time. |

| Customization Capabilities | Machines can be programmed for various bag sizes, shapes, and designs to meet diverse needs. |

| Sustainability | Use of eco-friendly materials, energy efficiency, and waste reduction supported by AI systems. |

| Market Drivers | Regulatory pressures and demand for sustainable packaging boost AI adoption in the market. |

AI-driven quality control systems use image recognition and machine learning to detect defects in real time.

These systems ensure that each bag meets strict quality requirements, reducing waste and improving consistency.

AI enables rapid adjustments to machine settings, maintaining high standards even during large production runs.

AI also supports advanced customization, allowing manufacturers to quickly switch between different bag sizes, shapes, and designs. This flexibility meets the growing demand for personalized and eco-friendly packaging.

IoT connectivity has become a cornerstone of modern bag making machine design. By linking machines, sensors, and operators, IoT enables real-time data exchange and remote management.

IoT-enabled machines collect and transmit data on processing parameters such as speed, acceleration, and position.

Operators monitor machine performance in real time, identifying issues before they impact production.

Data storage solutions, including cloud platforms, allow for historical analysis and continuous improvement.

| Parameter / Feature | Description / Value |

|---|---|

| Processing parameters | Acceleration, speed, position collected from two 5-axis machining centers |

| Condition monitoring data | Data from robotic part loading system for coordinate measuring machine (CMM) |

| IoT protocol | MQTT used for data transmission with topic-based data collection |

| Data storage | SQL database synchronization and Azure Blob cloud storage |

| ML model deployment | Docker container with API endpoint, Azure ML service for cloud deployment |

| Key Performance Indicator (KPI) | Computed via Trapezoidal Numerical Integration (TNI) per production cycle |

These capabilities support predictive maintenance and enhance machine performance, making small paper bag making machine operations more reliable and efficient.

Remote support features allow technicians to access machines from anywhere, diagnose problems, and implement solutions without on-site visits.

High-speed communication units and advanced controllers enable seamless connectivity.

Manufacturers benefit from reduced downtime and faster troubleshooting.

IoT connectivity empowers manufacturers to optimize production, maintain quality, and respond quickly to market demands.

Key Market Trends Supporting Adoption:

The global bag making machine market is projected to grow at a CAGR of 4.5% to 4.7% through 2028, driven by environmental concerns and regulations against plastics.

Emerging markets like China and India show increasing demand for automated, high-speed, and energy-efficient machines.

IoT, automation, and AI help manufacturers meet consumer preferences for eco-friendly, customizable, and high-quality paper bags.

Digitalization has become a driving force in the evolution of small paper bag making machines. This process transforms traditional manufacturing by integrating digital tools and intelligent systems. Companies now use digitalization to collect, analyze, and act on data in real time. These advancements help manufacturers respond quickly to market changes and improve overall efficiency.

Data analytics plays a crucial role in modern bag making operations. Machines equipped with advanced sensors and software collect large volumes of production data. Operators use this data to monitor machine performance, track output quality, and identify patterns that affect efficiency.

Manufacturers analyze production trends to optimize machine settings.

Data-driven insights help reduce downtime and predict maintenance needs.

Real-time dashboards display key metrics, such as output rates and defect counts.

Note: Data analytics enables companies to make informed decisions, leading to higher productivity and lower costs.

A leading packaging company recently adopted a data analytics platform for its small paper bag making machines. The platform provided instant feedback on production bottlenecks. As a result, the company increased output by 15% within six months. This example highlights how technological advancements in data analytics can deliver measurable business value.

Smart sensors represent one of the most significant advancements in the bag making industry. These sensors monitor critical parameters, such as temperature, pressure, and alignment, throughout the production process. They send real-time alerts when they detect deviations from optimal conditions.

Smart sensors ensure consistent bag quality by detecting defects early.

They support predictive maintenance by identifying wear and tear before failures occur.

Integration with IoT platforms allows remote monitoring and control.

| Sensor Type | Function | Benefit |

|---|---|---|

| Temperature | Monitors heat during sealing | Prevents weak seals |

| Pressure | Checks gluing and cutting force | Ensures strong, clean edges |

| Alignment | Tracks paper positioning | Reduces material waste |

These advancements in sensor technology contribute to safer, more reliable, and more sustainable manufacturing. Operators can adjust machine parameters instantly, reducing waste and improving energy efficiency. The combination of data analytics and smart sensors marks a new era of technological advancements in paper bag production.

Smart sensors and data analytics together create a feedback loop that drives continuous improvement.

Digitalization, supported by these advancements, positions small paper bag making machines at the forefront of modern manufacturing. Companies that embrace these technologies gain a competitive edge and meet the growing demand for high-quality, eco-friendly packaging.

The bag making machine market has seen a significant shift toward green materials. Manufacturers now prioritize paper sourced from certified sustainable forests and recycled content. This approach reduces deforestation and supports environmental sustainability. Many companies use certified compostable materials that decompose within 90 days, making them compatible with waste management systems. The adoption of renewable resources lowers carbon footprints and aligns with national sustainability goals. For example, some organizations aim to replace 70% of plastic packaging with compostable or recycled alternatives by 2030. These efforts contribute to sustainable development and help protect the environment.

Paper bag making machines now handle a wide range of sustainable packaging solutions, including compostable and biodegradable options.

The demand for green materials continues to rise as consumers and regulators push for eco-friendly packaging solutions.

Multi-functionality in modern machines enables the production of various bag types using different green materials.

Companies that invest in green materials not only reduce their environmental impact but also enhance their brand reputation in the packaging industry.

Eco-friendly processes have become a core focus in the bag making machine market. Manufacturers implement energy-saving technologies and use renewable energy sources, such as solar power, to reduce environmental impact. Water recycling and treatment systems help minimize water usage during production. Waste reduction and recycling practices optimize material use and decrease landfill disposal. The use of non-toxic chemicals ensures safety for both workers and the environment.

| Sustainability Aspect | Description |

|---|---|

| Material Sourcing | Use of paper from certified sustainable forests or recycled content to reduce deforestation. |

| Energy Efficiency | Implementation of energy-saving technologies and use of renewable energy sources like solar. |

| Water Conservation | Adoption of water recycling and treatment systems to minimize water usage. |

| Waste Reduction & Recycling | Optimization of material use and recycling of production waste to minimize landfill disposal. |

| Chemical Management | Use of environmentally friendly, non-toxic chemicals to ensure safety and reduce environmental impact. |

| Innovation in Design | Enhancements in bag strength, durability, and features such as reinforced handles and tear resistance. |

| Circular Economy Initiatives | Designing for recyclability, promoting recycling, and exploring compostable or biodegradable materials. |

| Life Cycle Assessments | Conducting assessments to evaluate and improve environmental impact of production. |

| Consumer Awareness | Educating consumers to promote sustainable packaging choices. |

Manufacturers also focus on innovation in design, improving bag strength and durability. Features like reinforced handles and moisture resistance support multi-use durability. These eco-friendly processes help companies comply with stricter environmental regulations and meet the growing demand for sustainable packaging solutions.

Digital transformation drives major changes in the bag making machine market. Big data analytics allows manufacturers to collect and analyze large volumes of production data. This data helps optimize machine settings, predict maintenance needs, and improve output quality. Real-time dashboards display key metrics, such as output rates and defect counts, enabling quick decision-making.

Integration of IoT and machine learning enhances real-time monitoring and predictive maintenance.

Companies use big data to identify trends and forecast demand for different packaging types.

Digital transformation accelerates technology adoption and operational efficiency in the bag making machine market.

Big data empowers manufacturers to respond quickly to market changes and deliver high-quality, sustainable packaging solutions.

Smart manufacturing combines automation, robotics, and AI to improve efficiency and product quality. Bag making machines now feature real-time monitoring, automatic adjustments, and fault detection. These advancements support sustainable packaging solutions by reducing waste and energy consumption.

Smart manufacturing enables the production of customized bags to meet specific consumer needs.

Industry 4.0 technologies, such as IoT and predictive maintenance, drive innovation in the bag making machine market.

Hybrid distribution models, combining online and offline channels, enhance customer convenience and sales growth.

The digital transformation of the bag making machine market supports environmental sustainability and helps companies meet evolving customer demands. Manufacturers that embrace smart manufacturing gain a competitive edge in the global packaging industry.

Business model innovation is reshaping the bag making machine market. Subscription services offer manufacturers access to the latest machines and technology without large upfront investments. This model provides flexibility and helps companies manage costs more effectively.

Subscription services support small and medium enterprises by lowering barriers to entry.

Regular upgrades and maintenance ensure machines remain efficient and up-to-date.

The forecast for subscription-based models shows steady growth as more companies seek scalable solutions.

Direct-to-consumer (D2C) approaches are gaining popularity in the packaging industry. Manufacturers use online sales channels and digital marketing to reach customers directly. This strategy increases product visibility and allows for greater customization of packaging solutions.

D2C models enable manufacturers to respond quickly to changing demand and market trends.

Hybrid distribution models balance convenience and personalized service for customers.

The bag making machine market benefits from increased sales growth and improved customer relationships.

Business model innovation, including subscription services and D2C approaches, positions manufacturers to thrive in a rapidly evolving market.

The bag making machine market continues to experience robust growth as sustainability becomes a global priority. Manufacturers see a surge in demand for biodegradable and recyclable bags, driven by stricter regulations on single-use plastics and a rising consumer preference for eco-friendly packaging. The forecast for the bag making machine market shows that companies must innovate to meet these expectations.

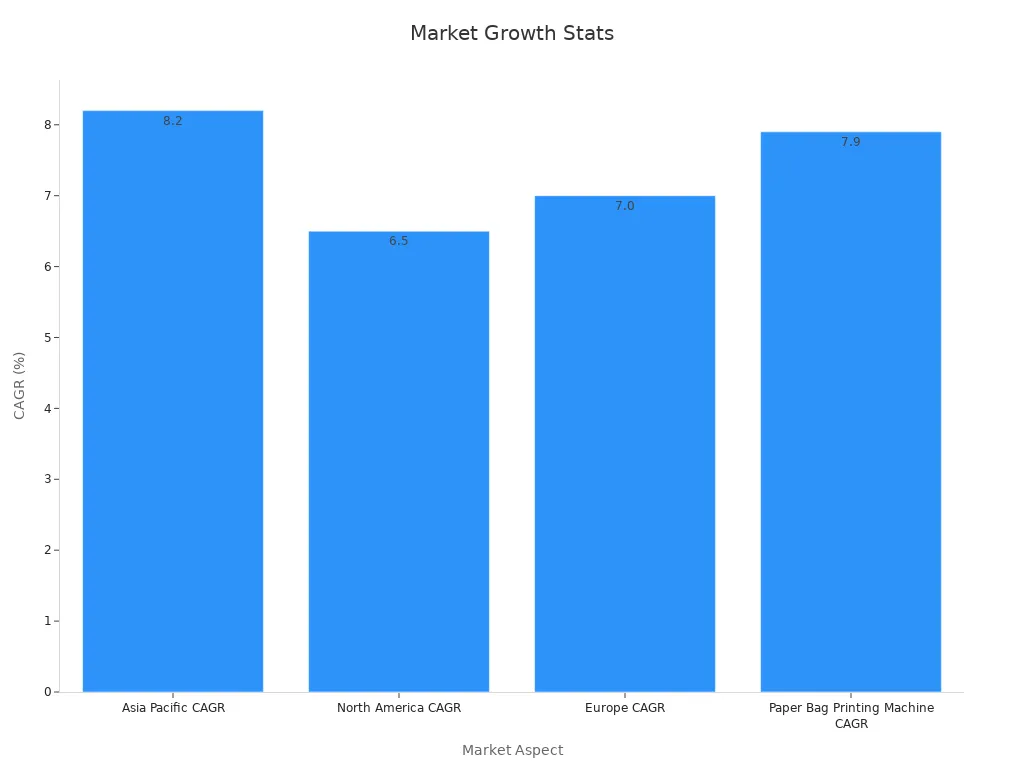

A closer look at regional trends reveals impressive growth rates. The Asia Pacific region leads with a compound annual growth rate (CAGR) of approximately 8.2% during the forecast period. North America and Europe follow with CAGRs of 6.5% and 7.0%, respectively. The paper bag printing machine segment is expected to grow at a 7.9% CAGR from 2025 to 2032. These statistics highlight the strong demand for advanced bag making machine technology.

| Market Aspect | Statistic / Insight |

|---|---|

| Asia Pacific CAGR | Approximately 8.2% growth rate during forecast period |

| North America CAGR | Approximately 6.5% growth rate during forecast period |

| Europe CAGR | Approximately 7.0% growth rate during forecast period |

| Paper Bag Printing Machine CAGR | Expected 7.9% CAGR from 2025 to 2032 |

| Machine Types | Fully automatic machines dominate due to efficiency and advanced features; semi-automatic machines remain significant for SMEs and developing regions |

| Key Growth Drivers | Environmental awareness, regulations on single-use plastics, shift to sustainable packaging, technological advancements (automation, digital controls) |

| End-User Sectors | Food & beverage, retail, pharmaceuticals, cosmetics, electronics, household goods |

| Regional Growth Drivers | Urbanization, industrialization, government regulations, expanding retail and food & beverage sectors |

| Market Opportunities | Innovation in automation and customization, expansion in emerging economies |

The bag making machine market benefits from innovation in automation and digital controls. Fully automatic machines now dominate, offering high efficiency and advanced features. However, semi-automatic machines remain important for small and medium enterprises in developing regions. The forecast indicates that the demand for biodegradable and recyclable bags will continue to rise, especially in the food and beverage, retail, and pharmaceutical sectors.

Flat bottom bags have gained popularity in the bag making machine market due to their versatility and strong shelf presence. These bags offer greater stability and can hold more products, making them ideal for a wide range of applications. The demand for flat bottom bags has increased as brands seek packaging that combines functionality with visual appeal.

Manufacturers respond to this trend by investing in bag making machine technology that supports the production of flat bottom bags. The forecast for 2025 and beyond shows that flat bottom bags will remain a preferred choice for both retailers and consumers. Companies that adapt their bag making machine lines to produce these bags can capture new market opportunities and meet the evolving needs of their customers.

Note: The bag making machine market will continue to evolve as trends shift toward sustainability, automation, and customization. Companies that monitor these trends and invest in innovative solutions will lead the market in the coming years.

Smart technology has transformed efficiency in paper bag manufacturing. Automated systems now handle repetitive tasks with speed and accuracy. Machines equipped with programmable logic controllers (PLCs) manage high-speed production lines, reducing human error and increasing output. IoT sensors monitor every stage of the process, from raw material handling to final packaging. This real-time monitoring allows operators to identify and resolve issues quickly, minimizing downtime.

AI-powered predictive maintenance further boosts efficiency. These systems analyze machine data to predict when parts need service, preventing unexpected breakdowns. As a result, manufacturers maintain continuous production and meet rising demand for packaging. Energy-efficient machines also lower operational costs and reduce environmental impact. Companies can now produce more paper bags in less time, supporting the fast-paced needs of the packaging industry.

The demand for customizable paper bags continues to grow as brands seek unique packaging solutions. Smart technology enables manufacturers to offer a wide range of sizes, shapes, and designs. Modular machine designs provide flexibility, allowing quick adjustments for different orders. IoT connectivity supports real-time monitoring and remote diagnostics, ensuring smooth transitions between customized runs.

IoT sensors track production quality and performance, maintaining consistency during customization.

Predictive maintenance reduces downtime, supporting continuous production of customized bags.

Automation with PLC-controlled machines enables high-speed, flexible manufacturing.

Tailored machine designs meet specific customer requirements, enhancing the ability to deliver niche packaging solutions.

Digital printing technology allows for small batch production without excess waste. This capability supports sustainable packaging solutions and meets the needs of businesses that require personalized packaging. Quality control automation ensures each customized bag meets strict standards, building trust with customers and supporting brand reputation.

Sustainability remains a top priority in paper bag production. Smart technology plays a key role in reducing the environmental impact of packaging manufacturing. Energy-efficient machines consume less power, lowering carbon footprints. Real-time monitoring and AI-driven systems help minimize waste by optimizing material use and detecting defects early.

The recycled paper bag market is projected to grow from USD 4.5 billion in 2024 to USD 8.2 billion by 2033, with a CAGR of 7.5%. This growth highlights the impact of smart technology on sustainable packaging. Manufacturers now use digital printing to create personalized packaging without generating excess waste. Advancements in recycling and manufacturing have produced stronger, water-resistant paper bags that rival plastic alternatives.

AI and automation improve efficiency and reduce human error.

Predictive maintenance ensures continuous, sustainable production.

Flexible machine designs adapt to changing market demand for eco-friendly packaging.

These innovations support the shift toward sustainable packaging solutions. Companies that invest in smart technology not only meet regulatory requirements but also appeal to environmentally conscious consumers. The focus on sustainability drives growth in the packaging industry and positions paper bag manufacturing as a leader in environmental responsibility.

Smart technology delivers measurable cost savings for manufacturers in the paper bag industry. Automated systems streamline production, reduce manual labor, and optimize resource use. Companies that invest in advanced machinery see immediate financial benefits across several areas.

Automation reduces energy consumption by about 20%. Energy-efficient machines use less power during operation, which lowers utility bills and supports sustainability goals. Manufacturers also save on raw materials. By purchasing recycled materials in bulk and negotiating with suppliers, companies cut raw material costs by 10-15%. These savings help businesses remain competitive in a market that values both cost efficiency and environmental responsibility.

Waste reduction stands out as another major advantage. Optimized inventory management and recycling processes decrease waste by up to 25%. This not only saves money but also minimizes the environmental impact of production. Improved inventory management absorbs about 15% of the initial budget, highlighting the importance of efficient systems.

Quality control measures, powered by AI and smart sensors, reduce production defects to below 2%. Fewer defects mean less rework and lower material costs. Streamlined logistics and consolidated shipments further reduce distribution costs by nearly 15%. These improvements make it easier for manufacturers to deliver products on time and at lower prices.

The following table summarizes key cost-saving aspects in modern paper bag manufacturing:

| Cost Saving Aspect | Numerical Data | Description |

|---|---|---|

| Energy consumption savings | ~20% | Energy-efficient machinery and best practices reduce power usage. |

| Raw material cost reduction | 10-15% | Bulk purchasing and supplier negotiations for recycled materials lower costs. |

| Waste reduction | Up to 25% | Optimized inventory and recycling processes decrease waste. |

| Inventory management cost | 15% of initial budget | Efficient systems absorb a significant portion of the budget, emphasizing optimization. |

| Production defects reduction | Below 2% | Quality control minimizes defects, supporting lean and sustainable production. |

| Distribution cost reduction | Nearly 15% | Streamlined logistics and shipments lower transportation expenses. |

Companies that adopt smart technology in their production lines gain a clear financial edge. Lower operational costs, reduced waste, and improved efficiency allow them to offer high-quality paper bags at competitive prices.

Investment remains one of the most significant barriers for companies considering smart technology in paper bag making machines. Many manufacturers face high upfront costs when upgrading to automated systems, AI-driven controls, and IoT-enabled devices. The market often experiences fluctuating raw material prices, such as wood pulp and recycled paper. These price swings increase manufacturing costs and reduce profitability, making it harder for firms to allocate funds for new technology.

Reports from the Canada Square Bottom Paper Bag Machine Market highlight capital intensity and concerns over return on investment as major financial hurdles. Small and medium-sized enterprises (SMEs) feel this pressure most acutely. A systematic review of SMEs found that high investment costs and uncertainty about ROI are among the top reasons companies hesitate to adopt smart manufacturing solutions. Many businesses worry that the benefits of smart technology may not outweigh the initial expenses, especially when profit margins are already thin.

Statistical analyses, such as hierarchical regression models and exploratory factor analysis, show that internal economic factors—like cost challenges and infrastructure limitations—are the primary obstacles to smart technology adoption. Organizational resistance and lack of training also play a role, but financial concerns remain at the forefront.

Companies must carefully weigh the long-term benefits of smart solutions against the immediate financial risks.

The shift toward smart manufacturing exposes a significant skills gap in the workforce. Many operators and technicians lack experience with advanced automation, AI, and IoT systems. Traditional manufacturing relied on manual processes, but smart machines require knowledge of programming, data analysis, and digital troubleshooting.

Manufacturers often struggle to find employees with the right technical background. Training programs can help, but they require time and resources. Without skilled personnel, companies cannot fully leverage the capabilities of new machines. This gap slows down the adoption of smart solutions and can lead to operational errors or underutilized equipment.

Investing in workforce development is essential for successful digital transformation.

Integrating smart systems into existing paper bag making machines presents technical and operational challenges. Many factories use legacy equipment with outdated communication protocols, such as RS-422, RS-485, Modbus, or PROFIBUS. These older systems often require adapters or gateways to connect with modern IoT platforms.

| Technical Challenge | Description |

|---|---|

| Legacy Protocols | Incompatibility with modern IoT standards; need for adapters |

| Retrofitting Complexity | Organizing sensors, connectivity, and data layers for valuable insights |

| Data Standardization | Need for common protocols like OPC-UA, MQTT, MTConnect |

| IT/OT Convergence | Merging operational and information technology for real-time decision making |

Retrofitting existing machines involves organizing sensor networks, connectivity, and data layers to generate actionable insights. The process can be complex and time-consuming. Factories must also address cybersecurity risks, as digital integration increases exposure to potential threats. Achieving seamless interoperability requires standardization and careful planning.

Successful integration of smart solutions depends on both technical upgrades and a clear digital strategy.

Data security stands as a critical concern for manufacturers adopting smart technology in paper bag making machines. As these machines connect to networks and cloud platforms, they become vulnerable to cyber threats. Hackers may target sensitive production data, machine settings, or customer information. Companies must protect their systems from unauthorized access and data breaches.

Manufacturers often use firewalls, encryption, and secure communication protocols to safeguard their operations. Regular software updates help close security gaps. Many companies also train employees to recognize phishing attempts and suspicious activity. These steps reduce the risk of cyberattacks and keep production running smoothly.

Smart machines collect large amounts of data from sensors and controllers. This data helps improve efficiency and quality, but it also creates new risks. If attackers gain access, they could disrupt production or steal valuable information. Companies must balance the benefits of data collection with the need for strong security.

Tip: Companies should perform regular security audits and update their cybersecurity policies to address new threats.

A table below summarizes common data security measures:

| Security Measure | Purpose |

|---|---|

| Firewalls | Block unauthorized network access |

| Encryption | Protect data during transmission |

| Secure Protocols | Ensure safe communication between devices |

| Employee Training | Prevent social engineering attacks |

| Regular Updates | Fix vulnerabilities in software |

Manufacturers who invest in robust data security build trust with customers and partners. They also protect their reputation and avoid costly downtime. As smart technology becomes more common, data security will remain a top priority in the paper bag making industry.

Maintenance plays a vital role in the long-term success of smart paper bag making machines. Modern machines often feature designs that simplify upkeep. Many manufacturers describe their equipment as "easy to maintain," which helps reduce the effort and complexity of routine servicing.

Operators must follow instruction manuals and perform regular maintenance tasks. These actions extend the lifespan of machines, which can reach up to 30 years with proper care. Companies like MTED provide comprehensive training programs for their clients. These sessions cover installation, safety, and maintenance procedures. Well-trained operators can spot issues early and keep machines running efficiently.

Manufacturers also offer strong after-sales support. Services include onsite installation, maintenance assistance, and remote troubleshooting. This support helps clients solve problems quickly and avoid long periods of downtime.

Key maintenance considerations for smart paper bag making machines include:

Routine inspections of moving parts and sensors

Lubrication of mechanical components

Software updates and system checks

Replacement of worn or damaged parts

Training for operators on new features or updates

Regular maintenance not only prevents unexpected breakdowns but also ensures consistent product quality.

Smart machines may require less frequent but more specialized maintenance compared to traditional models. As technology advances, manufacturers continue to design machines that are easier to service. This focus on maintenance helps companies maximize their investment and maintain high production standards.

Industry 4.0 is transforming the small paper bag making machine sector. Manufacturers now use smart sensors, automation, and data analytics to create connected production environments. Machines communicate with each other and with operators, sharing real-time information. This connectivity allows for predictive maintenance, faster troubleshooting, and improved efficiency. Companies benefit from reduced downtime and higher output. The integration of AI and IoT supports flexible manufacturing, enabling quick changes in production lines to meet shifting packaging demands.

Key growth projections highlight the impact of Industry 4.0:

The small paper bag making machine industry is projected to grow at a CAGR of 6% from 2025 to 2033.

Market size is expected to increase from $1.5 billion in 2025 to $2.5 billion by 2033.

Growth is driven by demand for eco-friendly packaging, strict regulations against plastic bags, and rising consumer preference for sustainable solutions.

The expanding e-commerce sector and technological advancements, such as automation and digitalization, fuel this trend.

Asia-Pacific, especially India and China, will lead regional growth due to large manufacturing bases and increased consumer spending.

Industry 4.0 enables manufacturers to respond quickly to market changes and deliver high-quality packaging efficiently.

Flexographic printing, or flexo printing, has become the standard in paper bag production. This technology allows for high-quality custom branding while maintaining the recyclability and sustainability of paper bags. Flexo printing uses eco-friendly inks that enhance visual appeal without harming the environment. Brands can showcase vibrant, intricate designs and communicate their identity to eco-conscious consumers. The technology supports the use of water-based, solventless, and energy-curable inks, aligning with environmental goals.

Flexo printing dominates paper bag printing with 95% usage.

Innovations in UV and EB inks improve print quality and sustainability.

Hybrid digital-flexo systems enable greater customization and operational efficiency.

Automation and AI-based quality control modernize flexo printing, increasing speed and consistency.

Specialty inks, such as metallic and glow-in-the-dark, expand design possibilities.

Flexo printing helps brands balance aesthetic appeal with sustainability, strengthening their position in a competitive packaging market.

Reusable packaging is gaining momentum in the paper bag industry. Companies and governments promote eco-friendly solutions to reduce waste and support environmental goals. Reports show that the market for reusable paper and cardboard packaging, including paper bags, continues to grow. Government initiatives, such as India's National Mission for Clean Ganga, encourage the use of agricultural waste materials in packaging. Financial incentives, including tax benefits and subsidies, support businesses adopting sustainable practices.

Regulations on single-use plastics and the promotion of recyclable materials drive market growth.

The surge in e-commerce after the pandemic increases demand for reusable paper bag packaging.

Technology, such as QR codes, creates new opportunities for reusable packaging.

Challenges like fluctuating raw material prices and regulations on resource use affect the market but do not slow the overall trend.

Reusable packaging supports a circular economy and meets the needs of environmentally conscious consumers. Companies that invest in reusable solutions position themselves for long-term success in the evolving packaging landscape.

The future of small paper bag making machines centers on customization. Manufacturers now recognize that businesses want packaging that reflects their brand identity and meets specific functional needs. Custom sizes and styles have become essential for companies in retail, food service, agriculture, and cosmetics.

Retailers and food service providers use custom-printed paper bags to promote their brands. Starbucks and H&M, for example, rely on branded bags to reinforce their image and eco-friendly values.

Market segmentation by style—such as flat bags, D-cut, pinch bottom, square bottom, and V-bottom—shows the growing demand for diverse options. Each style serves a unique purpose, from carrying groceries to packaging cosmetics.

Capacity segmentation into small, medium, and large bags allows businesses to choose the right size for their products. This flexibility supports a wide range of end-user needs.

Consumer preferences have shifted toward eco-friendly and visually appealing packaging. Customization helps brands meet these expectations while complying with sustainability mandates.

Regulatory bans on single-use plastics push manufacturers to develop paper bags that fit specific industry and environmental requirements.

Material innovations and digital printing technologies enable high levels of personalization. Companies can now print vibrant logos, product information, and promotional messages directly onto bags.

The rise of e-commerce increases the need for packaging with optimized dimensions and enhanced durability. Custom sizes ensure that products arrive safely and efficiently.

Supply chain agility and regional diversification make it easier for manufacturers to produce and distribute customized paper bags quickly.

The paper bags market continues to grow, with a projected CAGR of 5.57% and an expected value of USD 8.29 billion by 2030. This growth reflects the increasing importance of custom options. Manufacturers invest in coated, cotton, kraft, and specialty papers to offer more choices. Material innovations improve bag strength and functionality, allowing paper bags to serve broader product segments.

Customization is not just about aesthetics. It also addresses practical needs, such as tear resistance and product protection, especially for e-commerce shipments.

Digital printing and automated systems have transformed the supply chain. Brands can now respond quickly to market trends and customer requests. Personalized packaging strengthens brand loyalty and supports marketing efforts.

Manufacturers who embrace custom sizes and styles position themselves as leaders in a competitive market. They meet the evolving demands of businesses and consumers while supporting sustainability and innovation.

Smart technology continues to redefine the bag making machine market. Manufacturers see greater efficiency, improved packaging quality, and better sustainability. The bag making machine market faces challenges such as high investment and a growing skills gap. Companies should monitor trends and use the latest forecast data to guide decisions. The bag making machine market will reward those who adapt quickly. Staying informed about packaging innovations and forecast updates helps businesses lead in the bag making machine market.

The bag making machine market grows due to rising demand for sustainable packaging, automation, and digitalization. The forecast shows strong expansion, especially in Asia-Pacific. Manufacturers invest in advanced technology to meet evolving customer needs and regulatory requirements.

Smart technology automates processes and enables real-time monitoring. Operators use data analytics to optimize performance. The forecast indicates that these advancements help manufacturers increase output and reduce downtime, strengthening their position in the bag making machine market.

Sustainability shapes the bag making machine market as consumers and governments demand eco-friendly solutions. The forecast highlights a shift toward biodegradable materials and energy-efficient machines. Companies that prioritize sustainability gain a competitive edge and meet regulatory standards.

High investment costs, skills gaps, and integration issues challenge new entrants. The forecast suggests that companies must address these barriers to succeed. Data security and ongoing maintenance also require attention in the evolving bag making machine market.

The forecast provides insights into market trends, growth rates, and technology adoption. Decision-makers use this information to plan investments, develop new products, and expand operations. Accurate forecasts help companies stay ahead in the competitive bag making machine market.

The forecast points to increased automation, digital transformation, and demand for biodegradable bags. Subscription models and direct-to-consumer strategies will gain traction. Companies that adapt to these trends will lead the bag making machine market.

Manufacturers analyze the forecast to identify emerging opportunities and risks. They invest in R&D to develop machines with advanced features. The bag making machine market rewards innovation, especially when companies anticipate changes highlighted in the forecast.

Small businesses use the forecast to identify growth sectors and plan investments. The bag making machine market offers opportunities for SMEs, especially with flexible machines and subscription services. Accurate forecasts help small companies compete with larger players.