- All

- Product Name

- Product Keyword

- Product Model

- Product Summary

- Product Description

- Multi Field Search

Views: 0 Author: Site Editor Publish Time: 2025-07-28 Origin: Site

Industry forecasts show that fully automatic machines will hold the largest share of the paper bag making machine market in 2025. Companies in this sector monitor market share closely to benchmark performance and refine strategies.

Leading firms influence the paper bag making machine market through innovation, partnerships, and product launches.

Market share analysis helps businesses respond to consumer demand shifts and regulatory changes.

Investors track the paper bag making machine market to spot growth opportunities and manage risk.

Current trends, such as the rise of automation and sustainability, drive rapid changes across the paper bag making machine market. Stakeholders who understand The Market Share of Semi Automatic Paper Bag Making Machine can better align strategies with evolving industry dynamics.

Industry experts expect fully automatic machines to lead the paper bag making machine market in 2025. These machines offer high-speed production and advanced automation. Many large manufacturers invest in fully automatic models to meet the rising demand for sustainable paper packaging. Semi automatic machines still hold a significant share, especially among small and medium enterprises. These businesses value flexibility and lower initial investment.

Note: The shift toward automation in the paper bag making machine market reflects the growing need for efficiency and consistency in packaging production.

Key players such as Windmöller & Hölscher, Holweg Weber, and Newlong Machine Works continue to innovate. Their focus on technology and reliability strengthens their positions in the market. The analysis shows that companies with a diverse product portfolio can capture a broader customer base.

The paper bag making machine market will reach new heights in 2025. Analysts project the global market value to surpass $1.5 billion. Fully automatic machines are expected to account for over 60% of the total market share. Semi automatic machines will maintain a strong presence, especially in regions with emerging economies.

| Segment | Market Share (2025) | Key Regions |

|---|---|---|

| Fully Automatic | 60%+ | Asia-Pacific, Europe |

| Semi Automatic | ~35% | Asia-Pacific, Africa |

| Manual | <5% | Limited |

The paper bag making machine market sees strong demand from the food packaging and retail sectors.

Asia-Pacific leads in both production and consumption of paper bags.

The market analysis highlights a steady increase in machine installations across developing countries.

The paper bag making machine market shows robust growth rates for both machine types. Fully automatic machines will see a compound annual growth rate (CAGR) of around 7.5% through 2025. Semi automatic machines will grow at a slower pace, with a projected CAGR of 4.2%.

Several factors drive market growth:

Rising demand for eco-friendly paper packaging.

Government regulations banning plastic bags.

Increased investment in advanced machines by large packaging companies.

The analysis indicates that regions with strong environmental policies experience faster adoption of fully automatic machines.

Manufacturers who adapt to changing market trends and invest in research and development will likely secure a larger share of the paper bag making machine market. The ongoing shift from plastic to paper packaging continues to fuel demand for both semi automatic and fully automatic machines.

The paper bag making machine market has experienced steady expansion over the past five years. In 2023, the global market reached a significant milestone, driven by increased environmental awareness and the shift toward sustainable packaging. The market is projected to achieve a value of approximately USD 0.71 billion by 2030, with a compound annual growth rate of 4.5% from 2024 to 2030. This growth reflects rising demand for paper bags in retail, e-commerce, and the food and beverage industries. Regulations limiting plastic bag use have also played a crucial role in shaping the market. Despite challenges such as high initial investment and fluctuating raw material prices, the paper bag making machine market continues to expand as businesses seek eco-friendly alternatives.

The paper bag making machine market segments by operation mode and production method. Each segment serves different business needs and production scales. The following table summarizes the main operation modes and their roles in the market:

| Operation Mode | Description | Recent Valuation and Market Trends |

|---|---|---|

| Automatic | Fully automated machines with advanced features like IoT and AI, enabling continuous operation and high efficiency. | Automatic machines dominate the paper converting machine market due to efficiency and advanced features, favored by large-scale manufacturers aiming to optimize workflows and reduce costs. |

| Semi-automatic | Machines combining manual intervention with automated processes, suitable for small to medium enterprises. | Semi-automatic machines serve as a cost-effective middle ground, maintaining relevance as businesses transition towards automation. |

| Manual | Machines operated entirely by hand, used for niche, low-volume, or highly customized production. | Manual machines hold a smaller market share but remain important for specialized applications requiring precision and customization. |

The market also distinguishes between continuous and intermittent production systems. Continuous machines support nonstop, high-volume bag manufacturing, while intermittent machines allow for flexible, batch-based production. Both systems address the diverse needs of the paper bag making machine market.

Several companies lead the paper bag making machine market, each contributing to innovation and market growth. Key players include:

SAHIL GRAPHICS

Prakash Group of Industries

Ronald

Curioni Sun Teramo

Holweg Weber

Newlong Industrial

Nova Machinery

Sunhope Packaging Machinery

Windmoeller & Hoelscher

Jiangsu Fangbang Machinery

Jiangsu Nanjiang Machinery

Nanjing Zono Machine Equipment

Rokin Machinery

Ruian Lilin Machinery

Wenzhou Nova Machinery

Zhejiang Zhuxin Machinery

These companies hold strong positions in the paper bag making machine market through advanced technology, reliable machines, and a broad product range. While specific market shares vary, these major players shape the direction of the market and set industry standards. Their focus on research and development ensures that both semi automatic and fully automatic paper bag making machines remain competitive and efficient.

Note: The presence of both established and emerging companies in the paper bag making machine market fosters healthy competition and continuous improvement in bag production technology.

The market share of semi automatic paper bag making machine remains significant in 2025. Analysts estimate that these machines account for about 35% of the global market. Many small and medium enterprises continue to choose these machines because they offer a balance between automation and manual control. The market shows steady growth, with a compound annual growth rate near 4.2%. This growth reflects the ongoing demand for flexible and cost-effective solutions in paper bag production. Companies in regions with emerging economies often rely on these machines to meet local packaging needs. The market share of semi automatic paper bag making machine demonstrates resilience despite the rise of fully automatic models.

Several factors contribute to the growth of the market share of semi automatic paper bag making machine. These drivers help manufacturers and businesses maintain a competitive edge.

Cost effectiveness stands out as a primary reason for the popularity of these machines. Many businesses, especially those with limited capital, find the initial investment for semi automatic machines more manageable than for fully automatic models. Operating costs also remain lower, which appeals to companies seeking to maximize profit margins. The market benefits from this affordability, as more enterprises can enter the paper bag production sector without facing prohibitive expenses.

Flexibility represents another key advantage. Semi automatic machines allow operators to adjust settings quickly for different bag sizes and designs. This adaptability supports customized packaging, which many brands use to differentiate their products. The market share of semi automatic paper bag making machine grows as businesses respond to changing consumer preferences and branding needs. These machines also suit medium-to-high volume production, making them ideal for companies that require both efficiency and versatility.

Key growth drivers for the market share of semi automatic paper bag making machine include:

Rising demand for sustainable and eco-friendly packaging as alternatives to plastic bags.

Increasing adoption of automation technologies to improve productivity and efficiency.

Growing need for customized packaging to support brand differentiation and product appeal.

Expansion of e-commerce and online retail sectors driving demand for cost-effective and reliable packaging.

Technological advancements including improved machine speed, print quality, and automation integration.

Despite strong growth, the market share of semi automatic paper bag making machine faces several challenges. High initial investment costs for advanced machines can limit access for some small and medium enterprises. Fluctuating raw material prices, especially for recycled paper and pulp, increase production costs and reduce profitability. The global price of paper has risen by about 20% in the last year, putting additional pressure on manufacturers.

Competition from plastic packaging remains strong. Many businesses still choose plastic due to its lower cost and convenience, even as sustainability becomes more important. Regulatory requirements also vary by region, forcing manufacturers to balance environmental compliance with efficient production. Ongoing global supply chain disruptions, caused by geopolitical tensions and the COVID-19 pandemic, complicate raw material procurement and product delivery. These factors challenge the ability of the market share of semi automatic paper bag making machine to grow at a faster pace.

Fully automatic paper bag making machines have become the dominant force in the global market. In 2025, these machines account for more than 60% of total installations. Large manufacturers and multinational brands prefer fully automatic machines because they deliver high-speed production and consistent quality. The market continues to shift toward automation as companies seek to meet rising demand for sustainable packaging. Fully automatic machines now set the standard for efficiency and reliability in the industry.

Several factors drive the rapid adoption of fully automatic paper bag making machines across the market. Companies in different regions respond to unique opportunities and challenges, but the push for automation remains strong.

Efficiency stands at the core of the appeal for fully automatic machines. These machines can produce thousands of bags per hour with minimal human intervention. Manufacturers benefit from reduced labor costs and fewer errors. Improved material handling systems and advanced user interfaces help operators monitor production and quickly resolve issues. Remote diagnostics and real-time data tracking further reduce downtime and boost productivity.

Technology advancements play a major role in the growth of fully automatic machines. Many companies now integrate artificial intelligence, IoT, and machine learning into their production lines. These features allow machines to adjust settings automatically, optimize energy use, and maintain high output. The market also sees growing demand for customization, with machines able to produce bags in various sizes, shapes, and designs. Digital integration supports capacity expansion, especially in Asia-Pacific, where e-commerce and food delivery services drive rapid growth.

Key growth drivers for fully automatic machines include:

Expanding retail networks in Latin America, which increase demand for sustainable packaging and local service support.

Environmental directives in Europe, promoting recycled fibers and energy-efficient machinery.

New investments in automated lines for retail and hospitality in the Middle East and Africa, creating opportunities for modular equipment.

Capacity expansion and digital integration in Asia-Pacific, fueled by food delivery and e-commerce growth.

US tariffs leading to nearshoring, strategic alliances, and a focus on operational efficiency and retrofit offerings.

Despite strong momentum, several barriers limit the growth of fully automatic paper bag making machines in the market.

High initial investment costs make these machines less accessible for small and medium-sized enterprises.

Competition from alternative sustainable packaging, such as reusable cloth bags and biodegradable plastics, challenges market expansion.

Fluctuations in the availability and cost of raw materials, especially paper, disrupt production and increase expenses.

Technical limitations prevent some machines from producing specialized bag types or working with new sustainable materials.

Maintenance requirements and a shortage of skilled labor create operational challenges for manufacturers.

Manufacturers who address these barriers can strengthen their position in the market and unlock new growth opportunities for fully automatic machines.

Asia-Pacific leads the global paper bag making machine market in 2025. Countries in this region show diverse strengths and market drivers. China holds the largest market share, acting as a global manufacturing hub. The country excels in AI, 5G, and smart manufacturing, which supports its dominance in e-commerce and packaging. India experiences rapid growth, fueled by its expanding IT services and e-commerce sectors. Japan maintains a significant share, leveraging robotics and IoT integration to enhance production efficiency. South Korea stands out for its innovation in semiconductors and smart technologies, which influence its market position. Singapore serves as a regional hub, focusing on digital transformation and logistics. Australia holds a niche market share, with strengths in renewable energy and healthcare research.

| Country | Market Share Position | Key Strengths | Market Drivers and Focus Areas |

|---|---|---|---|

| China | Largest | AI, 5G, smart manufacturing, e-commerce | Manufacturing hub, high consumption |

| India | Rapidly growing | IT, e-commerce, AI development | E-commerce, IT sector demand |

| Japan | Significant | Robotics, IoT, precision healthcare | Advanced technology integration |

| South Korea | Notable | Semiconductors, consumer electronics, smart cities | AI and smart tech innovation |

| Singapore | Regional hub | AI, fintech, logistics | Medtech and logistics impact |

| Australia | Niche | Renewable energy, healthcare R&D | Renewable energy, healthcare R&D focus |

Asia-Pacific’s growth comes from urbanization, rising disposable incomes, and strong government initiatives to reduce plastic waste. Local manufacturing investments and the booming e-commerce sector further accelerate demand for both semi automatic and fully automatic machines.

Europe’s paper bag making machine market demonstrates steady growth and technological advancement. The region reached record production values in 2024, with gradual expansion expected through 2025 and beyond. Germany, Italy, and Luxembourg account for 81% of the region’s production, while Germany leads exports with 77%. Italy, France, and Poland serve as top importers. Consumption remains highest in Italy, Luxembourg, and Germany.

Projected CAGR exceeds 5.8% from 2023 to 2030, signaling ongoing market expansion.

Europe is expected to contribute over 35% of global revenue growth in this sector.

Technological advancements such as machine learning, AI, and data analytics improve precision and decision-making.

The market segments by machine type, automation level, production capacity, and product size.

Key end-user industries include retail, food and beverage, pharmaceuticals, cosmetics, packaging, and logistics.

Leading manufacturing countries: Germany, UK, France, Italy, Russia, and Turkey.

Notable manufacturers: Mohindra Mechanical Works, Sahil Graphics, Prakash Group, Windmöller & Hölscher.

European growth is driven by strict bans on single-use plastics, high consumer environmental awareness, and strong public-private partnerships. The region’s focus on sustainability and advanced automation supports the adoption of both semi automatic and fully automatic machines.

North America maintains a strong market share in paper bag making machines, supported by a mature retail infrastructure and high purchasing power. The United States leads the region, with the sheet-fed paper bag making machine market valued at $0.25 billion in 2024. Projections show growth to $0.35 billion by 2033, with a CAGR of 4.9% from 2026 to 2033. Environmental regulations, consumer preference for sustainable packaging, and bans on plastic bags drive this steady growth. Technological advancements, including automation and AI, improve production efficiency and product quality.

| Region | Market Share Characteristics | Growth Drivers and Trends | Growth Rate / CAGR |

|---|---|---|---|

| North America | Strong market share, mature retail, high purchasing power | Environmental regulations, sustainable packaging demand, plastic bag bans, automation, AI | U.S. CAGR 4.9% (2026-2033) |

North America’s market grows at a moderate pace compared to Asia-Pacific and Europe. The region’s focus on sustainability and technology ensures continued demand for both semi automatic and fully automatic paper bag making machines.

Emerging markets play a vital role in the global paper bag making machine industry in 2025. These regions show strong growth as businesses and governments respond to rising environmental concerns. Many countries in Asia, Latin America, and Africa now invest in sustainable packaging solutions. Local manufacturers and small businesses benefit from government support and new technologies. Urbanization and the expansion of retail, food, and e-commerce sectors also drive demand for paper bag making machines.

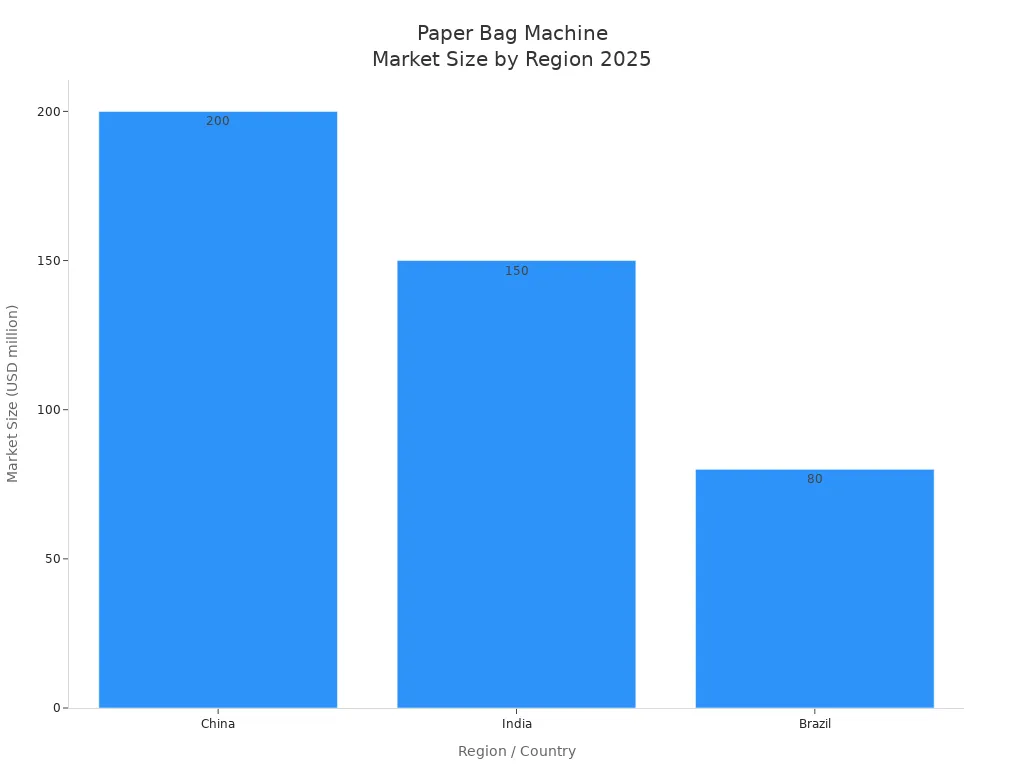

| Region / Country | Market Size (USD million) | CAGR (%) | Key Growth Drivers |

|---|---|---|---|

| China | 200 | 7.0 | Large manufacturing base, rising consumer environmental awareness |

| India | 150 | 6.8 | Expanding retail and e-commerce sectors, demand for sustainability |

| Brazil | 80 | 5.2 | Food & beverage industry demand for sustainable packaging |

| Middle East & Africa | N/A | Slower | Gradual shift to eco-friendly packaging |

China leads emerging markets with a large manufacturing base and growing consumer awareness about the environment. India follows closely, driven by its booming retail and e-commerce industries. Brazil shows steady progress as food and beverage companies seek sustainable packaging. The Middle East and Africa experience slower growth, but interest in eco-friendly options continues to rise.

Many emerging economies see rapid adoption of both semi automatic and fully automatic machines. Government regulations banning plastic bags encourage businesses to invest in paper bag production. Rising disposable incomes and technological improvements make advanced machinery more accessible to small and medium enterprises.

Manufacturers in these regions focus on flexible, cost-effective solutions to meet diverse customer needs. As sustainability trends strengthen, emerging markets will continue to shape the future of the paper bag making machine industry. Companies that adapt to local market drivers and invest in innovation can capture significant opportunities in these fast-growing regions.

Food packaging stands as a leading application for paper bag making machines in 2025. Companies in this sector respond to growing environmental awareness by shifting from plastic to paper. They use advanced machines that offer automation, precision, and smart controls. These features improve production efficiency and help meet strict food safety regulations. Manufacturers design machines to handle diverse production capacities, supporting both small bakeries and large foodservice chains.

Many food businesses choose paper bags for their eco-friendly qualities and compliance with government regulations.

The integration of IoT and smart technologies allows for better quality control and waste reduction. Brown kraft paper bags dominate the market, holding a 68% share due to their strength, moisture resistance, and breathability. Handle bags remain popular for bulk food orders, beverages, and groceries. Foodservice operators such as fast food outlets, restaurants, cafés, and supermarkets rely on these bags for daily operations.

| Application Aspect | Details |

|---|---|

| Sustainable Packaging | Biodegradable, recyclable bags meet eco-friendly consumer demand and regulations. |

| Food Freshness & Strength | Brown kraft paper bags preserve freshness and offer durability. |

| Convenience & Usability | Handle bags provide strength and ease of carrying. |

| Automation & Customization | Machines enable efficient production and branding opportunities. |

| Cost & Efficiency | Automation reduces labor costs and supports sustainability goals. |

Retailers use paper bag making machines to produce high-quality, fashionable bags for clothes and consumer goods. These bags serve as both packaging and branding tools. Retailers customize them with unique designs and prints, turning each bag into an advertising opportunity. The machines offer ease of use and cost-effectiveness, making them a preferred choice for stores in shopping malls and retail chains.

North America leads the market for these machines, driven by retail industry growth. The global paper bag market is projected to reach USD 6.4 billion in 2025, with the retail sector as a major contributor. In the Asia Pacific region, retailers hold a 30.2% share of the global market. Consumer demand for sturdy, visually appealing, and recyclable bags continues to rise. Businesses face pressure to adopt eco-friendly packaging, which further boosts the use of paper bags in retail.

Retailers value strong, durable bags that align with environmental regulations.

Customization options allow brands to stand out in a competitive market.

The shift to sustainable packaging supports both brand image and customer loyalty.

Industrial applications for paper bag making machines have expanded rapidly. Factories and large-scale producers use these machines to supply bags for sectors such as food, retail, pharmaceuticals, and e-commerce. Automation, AI, and IoT integration drive efficiency and reduce production costs. The industrial segment reached a market size of USD 4.2 billion in 2024, with strong growth expected through 2033.

| Aspect | Details |

|---|---|

| Role in Industry | Enables automated production for multiple sectors, including food and e-commerce. |

| Market Growth Drivers | Automation, energy efficiency, and government regulations support expansion. |

| Key Segments | Full automatic machines hold significant market share and drive innovation. |

| Industry Impact | Paper bags play a vital role in the shift to sustainable packaging. |

| Challenges | High capital investment, skilled labor shortages, and maintenance costs remain concerns. |

Industrial users benefit from machines that produce large volumes of bags with consistent quality. Companies like HOLWEG and W H focus on expanding their product portfolios and introducing new technologies. Innovation in machine design and digital integration improves productivity and supports sustainability goals. As e-commerce and food delivery services grow, the demand for industrial paper bags continues to increase.

Sustainability shapes the future of the paper bag making machine industry. Companies now prioritize machines that support eco-friendly production. The market trend analysis shows a rapid shift toward sustainable packaging solutions, driven by stricter regulations on single-use plastics and growing consumer environmental awareness. Manufacturers design machines to minimize energy consumption and operate on renewable energy sources. These innovations help reduce waste and improve operational efficiency.

A recent analysis highlights several key aspects of this trend:

| Aspect | Details |

|---|---|

| Market Growth | The paper bag market is projected to reach USD 7.81 billion by 2029. |

| Sustainability Drivers | Demand for biodegradable and compostable packaging materials is increasing. |

| Materials | More companies use recycled paper and biodegradable substances. |

| Machine Innovations | Automation and energy-efficient designs enable efficient production. |

| Brand Impact | Sustainable packaging enhances brand image and customer loyalty. |

Machines like the ZB 1450CT-550B integrate intelligent servo technology, supporting diverse bag styles and sustainable materials. This focus on sustainability impacts both semi automatic and fully automatic segments, as all manufacturers seek to align with global environmental goals.

Automation stands as a major market trend analysis point in 2025. Companies integrate AI, machine learning, IoT, and robotics into paper bag making machines. These technologies streamline production, reduce downtime, and increase output. IoT connectivity enables predictive maintenance, cutting machine downtime by up to 50%. Smart automation uses AI for predictive analytics, improving supply chain responsiveness and reducing lead times.

Automation frees workers from repetitive tasks, allowing them to focus on complex roles.

Energy-efficient machinery supports sustainability goals.

Both semi automatic and fully automatic machines benefit from these advancements, though fully automatic models lead in adopting the latest technologies.

Automation not only boosts productivity but also supports the use of biodegradable materials, further aligning with sustainable packaging solutions. This trend accelerates innovation and growth across the industry.

Consumer demand continues to drive changes in the paper bag making machine market. Environmental concerns push businesses to adopt paper bags, especially in the food and beverage sector. The analysis shows that consumers prefer sustainable and customizable packaging. Companies respond by investing in machines that support digital printing and branding.

The food and beverage sector leads demand for paper bags.

Businesses in take-out and delivery services increase orders for paper bag making machines.

Demand for customization and high-quality packaging rises, especially in emerging markets.

Technological advancements, such as automation and eco-friendly inks, help manufacturers meet these evolving needs. Both semi automatic and fully automatic machines adapt to these shifts, ensuring they remain relevant in a competitive market.

Companies that monitor these trends and invest in advanced machines position themselves for long-term success in the evolving packaging industry.

The paper bag making machine market in 2025 presents a wide range of investment opportunities. Companies can benefit from advances in technology, material science, and business models. Investors often look for areas that promise both growth and resilience. The following table highlights key investment areas and the factors that support them:

| Investment Opportunity Area | Supporting Evidence Summary |

|---|---|

| Technological Innovation | Modular automation and flexible systems allow rapid changes and customization for different applications. |

| Material Innovation | New blends of recycled and virgin fibers meet the needs of specialized packaging with barrier properties. |

| Tariff-Induced Supply Chain Shifts | US tariffs in 2025 encourage investment in local suppliers and turnkey solutions, reducing reliance on imports. |

| Sustainability Trends | Eco-conscious packaging drives demand for recyclable components, low-emission systems, and lifecycle assessments. |

| Regional Market Dynamics | Growth in North America, Asia-Pacific, Latin America, and Africa supports investments tailored to local regulations. |

| Market Segmentation Insights | Diverse applications and machine types guide targeted investments for food, chemical, and electronics sectors. |

| Business Model Innovation | Strategic partnerships, digital transformation, and service-focused models improve competitive advantage and retention. |

| Customization & Flexibility | Flexible manufacturing supports multiple operation modes and quick changeovers for diverse client needs. |

| Competitive Landscape & Business Models | Investments in R&D, automation, and partnerships help companies maintain leadership in a dynamic market. |

Investors who focus on these areas can position themselves for long-term success. Companies that embrace sustainability, digital transformation, and regional growth trends often outperform competitors.

New entrants in the paper bag making machine market face several significant challenges. High capital requirements often limit access for smaller firms. Strict regulations on environmental standards and product safety increase compliance costs. Intense competition from established players makes it difficult for newcomers to gain market share. Companies must also navigate complex supply chains and fluctuating raw material prices. Skilled labor shortages and the need for advanced technical expertise add further obstacles. These barriers require careful planning and resource allocation for successful market entry.

Note: Companies that invest in innovation, build strong partnerships, and optimize their value chain can overcome many of these barriers.

Selecting the right paper bag making machine in 2025 involves careful evaluation of operational needs, budget, and production goals. Companies must weigh the benefits and limitations of both semi automatic and fully automatic machines. The following table summarizes key factors to consider:

| Factor / Feature | Fully Automatic Machine | Semi-Automatic Machine |

|---|---|---|

| Cost | Higher initial purchase and running costs | More affordable, lower initial cost |

| Operational Efficiency | High precision, continuous and quick operations | Requires some human involvement, less automated |

| Production Speed | Up to 25,000 bags per hour or more | High speed but generally lower than fully automatic |

| Human Intervention | Minimal human supervision needed | Requires some manual input and supervision |

| Machine Features | Electromechanical motor-driven system, portability, rust and corrosion resistant | Robust construction, adjustable bag sizes, stainless steel construction |

| Maintenance Requirements | Durable materials, less frequent breakdowns, but potentially higher maintenance costs | Requires little maintenance, saves expenses |

| Adaptability to Bag Sizes | Less flexible, designed for continuous production of standard sizes | Flexible size adjustments with different size plates and gears |

| Power Consumption | Consumes power in the range of 3 to 4 HP motor | Consumes less power |

| Durability | Constructed with durable, long-lasting materials | Long durability, robust construction |

| Portability | Portable and space-saving | Varies by size, generally less portable |

Companies with high-volume, standardized production often choose fully automatic machines for speed and efficiency. Businesses seeking flexibility, lower costs, or custom orders may prefer semi automatic models.

Return on investment (ROI) remains a critical factor for decision-makers. The choice between semi automatic and fully automatic machines impacts both short-term and long-term profitability.

Semi-automatic machines consume less power, reducing operational costs.

Maintenance is easier and less expensive due to simpler design.

Human oversight during production ensures higher quality, which benefits niche markets.

Automation in fully automatic machines reduces labor costs, improving profitability.

Semi-automatic machines offer a sustainable and cost-effective investment for many businesses.

The table below compares ROI-related factors:

| Factor | Semi-Automatic Machines | Fully Automatic Machines |

|---|---|---|

| Initial Investment | Lower, suitable for small budgets | Higher, ideal for large factories |

| Production Speed | Moderate, fits small to medium output | High, designed for mass production |

| Flexibility | High, good for custom and small orders | Lower, best for large batch production |

| Maintenance | Simpler and less costly | More complex and expensive |

| Labor Costs | Higher, requires more manual labor | Lower, due to automation |

Semi-automatic machines deliver a quicker ROI for small and medium-sized businesses or those prioritizing customization and lower upfront costs. Fully automatic machines, despite higher initial investment, provide better ROI for large-scale operations through higher output and reduced labor expenses.

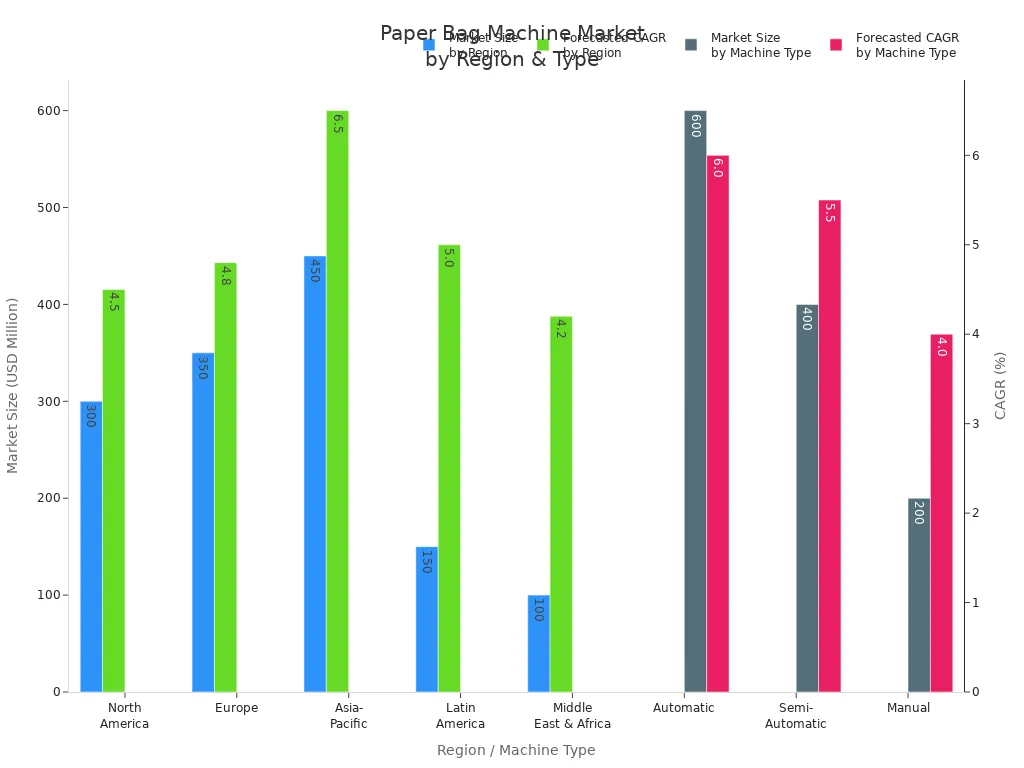

The paper bag making machine market shows strong growth potential beyond 2025. Technological advancements such as AI integration, blockchain for supply chain transparency, and circular economy practices drive innovation. Regulatory trends, including bans on single-use plastics and sustainability certifications, accelerate global adoption. The Asia-Pacific region, led by China and India, continues to expand rapidly due to industrialization and retail growth. Sustainability remains a central focus, with manufacturers emphasizing eco-friendly materials and energy optimization.

| Region | Current Market Size (USD Million) | Forecasted CAGR (%) |

|---|---|---|

| North America | 300 | 4.5% |

| Europe | 350 | 4.8% |

| Asia-Pacific | 450 | 6.5% |

| Latin America | 150 | 5.0% |

| Middle East & Africa | 100 | 4.2% |

| Machine Type | Current Market Size (USD Million) | Forecasted CAGR (%) |

|---|---|---|

| Automatic | 600 | 6.0% |

| Semi-Automatic | 400 | 5.5% |

| Manual | 200 | 4.0% |

The market outlook remains positive, with steady CAGR rates between 4% and 7%. Automatic machines are expected to dominate, but semi-automatic models will continue to serve businesses seeking flexibility and cost control.

Fully automatic paper bag making machines will lead the market in 2025 due to their speed, efficiency, and advanced technology. Businesses and investors should use up-to-date market data to guide their strategies.

Stakeholders can benefit from consulting industry experts or conducting further research.

Regularly tracking market trends helps companies adapt to new opportunities.

Staying informed and agile ensures long-term success in the evolving paper bag making machine industry.

Semi automatic machines require some manual input for operation. Fully automatic machines handle the entire process with minimal human intervention. Fully automatic models offer higher speed and efficiency.

Many small and medium enterprises select semi automatic machines for their lower cost and flexibility. These machines allow quick adjustments for different bag sizes and designs.

Yes, fully automatic machines often use advanced technology to optimize energy consumption. They reduce waste and improve production efficiency, which helps lower operating costs.

Asia-Pacific leads global adoption, especially China and India. Europe and North America also show strong demand due to environmental regulations and retail growth.

Governments enforce bans on single-use plastics and promote sustainable packaging. These regulations increase demand for paper bag making machines in many regions.

Companies should evaluate production volume, budget, required bag customization, and available labor. Fully automatic machines suit high-volume needs, while semi automatic models fit flexible, smaller-scale operations.

Yes, both machine types can produce customized bags. Semi automatic machines offer more flexibility for small batches. Fully automatic machines handle large orders with consistent quality.

Analysts project steady growth, with a compound annual growth rate between 4% and 7%. Demand for sustainable packaging and technological advancements will drive this trend.